Payroll Taxes – A Guide for Employers & Employees

Last Updated on July 19, 2023 by VantagePoint

Payroll taxes can be confusing for business owners. There are different taxes and rates depending on your work location and type of business. Luckily, there are companies like Vantage Point that can help you sort out the complexities of payroll taxes to make your payroll processing easy and simple.

What are payroll taxes?

Payroll taxes are the withholdings you keep from your employees’ pay in order to make contributions like income taxes, FICA taxes (for federal unemployment contributions), social security, and Medicare. It is important to note that employers are responsible for maintaining accurate payroll records and providing this information to their employees and the government.

Which fringe benefits are taxable and how?

When offering a new benefit to your employees, you will need to determine how it will impact your employees’ tax withholdings and the employer payroll taxes you will need to remit. There are some benefits that are not taxable, but many are considered taxable benefits. You should check out the IRS’ publication to see how your benefits are classified. Some benefits also have maximums that you must adhere to. For example, Health FSAs allow employees to make a tax-free contribution of up to $2,750 in 2020. Health insurance benefits are (mostly) not taxable, but personal use of a company vehicle is taxable.

What should employers do regarding payroll taxes?

First and foremost, you should be aware of when your taxes are due. If you are late paying your payroll taxes, the IRS will assess a “failure to deposit” penalty based on the number of days you are late. You will also be responsible for paying interest on the money owed.

States will have their own process for reporting and collecting payroll taxes. For example, in California, employers will submit a quarterly report to the state government, similar to the federal forms. Using a payroll provider can help you automate the submission of payments and forms as needed.

Here are some of the payroll deductions that you need to consider:

- 2% for social security (from both the employee and the employer)

- 45% for Medicare (employee and employer)

- 6% of the first $7,000 for FUTA (employee only)

- State unemployment taxes (varies)

- Any additional amounts the employee designates on the W-4

Pre-hire: federal and state registrations

Before you hire your first employee, you need to set up your business to hire and pay employees properly. The first thing would be to get an employer ID with the federal government by registering with the IRS to get an EIN. You may have done this as part of the initial business set up.

You will also need to set up an account for tax payments. To do this, you will have to set up an account with the Electronic Federal Tax Payment System (EFTPS). This will allow you to make your tax payments online.

You may also need to set up an employer account with your state. Most states require state income taxes to be paid, so you will need to register for those tax payments. In addition, you will also have to set up an account with the state department that handles unemployment insurance and determine what rate you will need to pay at the state level.

You may also be responsible for state workers’ compensation as well, although you may be able to purchase this through your insurance provider. Also, you may need to report new hires to the state on a regular basis. States use this information in order to garnish wages for child support.

How to calculate payroll tax deductions?

Payroll deductions are determined by the employee completing the W-4 form when they are hired. The W-4 takes into consideration the marital status, number of dependents, and salary in order to determine the withholding rate necessary.

Employees may also choose to have additional amounts withheld, which would be reflected on the W-4. Ideally, employees should complete the W-4 yearly or whenever their personal and/or financial situation changes because that will affect the amount of withholdings necessary. Employees are responsible for completing this form accurately.

Please note, the W-4 was updated as of January 2020. Please be sure you provide employees with the new form.

When must payroll taxes be filed and paid to the IRS?

Payroll taxes must be paid to the IRS on a regular basis. For most companies, this is done semi-weekly, though there are some companies that pay monthly. On a quarterly basis, companies must submit Form 941 to the IRS.

Federal unemployment taxes are due on a quarterly basis as well. On an annual basis, companies must provide their employees with payroll records in the form of a W-2. This allows employees to complete their taxes. Employers must also submit Form 940 and a tax deposit by the end of January.

How to set a proper payroll system?

A proper payroll system includes the requirements to properly withhold payments from employees, remit payments to the state and federal government, and provide employees with accurate payroll records.

In addition, it should clearly identify and rectify any payroll mistakes in a timely manner. A centralized payroll system is recommended to ensure that companies are compliant with all laws related to payroll.

A manual payroll process is not recommended, even for small companies. The time and energy required to oversee the payroll process and remitting payments to federal and state authorities are time-consuming and complicated.

The possibility of human error is high, especially for someone who is not an expert in payroll processes. It is highly recommended to use a payroll provider that has the expertise to guide your company through this process.

Our team of experts is at your disposal, please do reach out for any payroll questions!

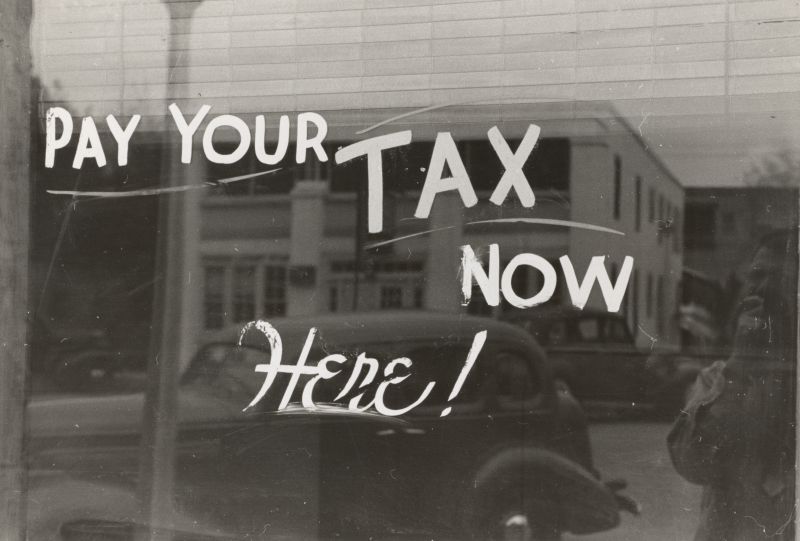

Photo credits: Unsplash